I'm sensing a lot of frustration and anger by the bears right now. The problem is that are trying to justify their bearishness by factors that don't really matter to the market. Here is a list of some of the reasons I've read recently:

1) The Iraq War - Sure, we are wasting lots of money and that is hurting our budget a little and may be causing some weakness in the dollar, but it's not that bearish.

2) We are still recovering from 9/11 - No, we have recovered from 9/11 and it's a non issue now. I can't believe people are still talking about this from a market standpoint.

3) The market has gone up 3 years in a row - So what! Valuations are still reasonable because corporate profits have been strong.

4) The housing market is imploding - No, the housing market is weakening, not imploding because the job market is strong and interest rates are still pretty low.

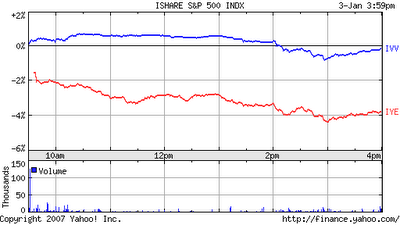

5) Billions of dollars are flowing into ETF's - Humm, that sounds bullish to me.

6) There is too much liquidity and hot money around the world - I don't know about too much. Strong liquidity is very bullish for the market. It only becomes a problem when it creates bubbles and then those bubbles pop when the money flows somewhere else. Housing got bubbly and is in a correction and oil is still in a bubble. Small and mid cap stocks look a little bubbly in general compared to large caps, but some of them still look highly attractive. REITs look bubbly so stay away from those.

7) Inflation is accelerating - There are pockets of inflation but there are also pockets of deflation. Just look at anything tech related like TV's and computers. Inflation will remain in check for many years because of tech, productivity, global competition and the global glut of labor.

8) The dollar is going to collapse - I'm not so sure about that. The budget deficit is improving from strong tax receipts and interest rates are higher than in many G7 countries, therefore the dollar is still attracting a lot of capital. Also, Japan and China want to support the dollar to keep their exports to the U.S. strong. This is the one area that I'm probably the most concerned about, however. I'd like to see some reforms and a balanced budget without tax increases. Cut the spending!

9) Everybody is expecting a soft landing - No, not everybody, but it is consensus right now. However, most market pundits are predicting meager gains. That's where I think they have it wrong. Equity gains will be strong in a 2% GDP growth environment because interest rates won't rise, inflation will cool, profits will be good and multiples will expand, probably similar to 1995.