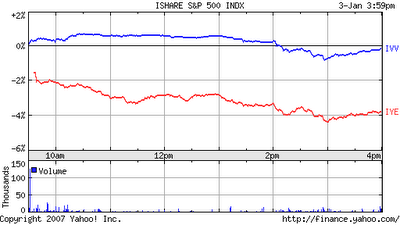

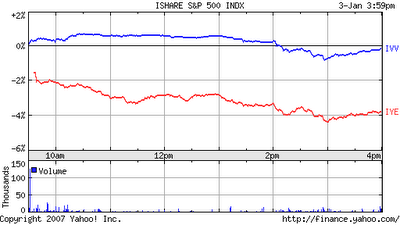

Nasty Crude Oil Action

Wow! It was nice to see some air taken out of the oil bubble today. The energy sector got crushed on worries about warm weather hurting demand and NBR's reduced earnings guidance. Check out this nasty action of the IYE (energy sector) vs the IVV (S&P 500):

If you have been reading this blog, you know that I'm an energy bear (see post: Crude Oil Set To Tank?). I stand by my call that supply can and will grow faster than demand in 07 and that OPEC cutting supply and freeing up spare capacity is a bearish event. If it were not for all of the hot money flowing into energy derivatives over the past couple years, the price of oil would be much, much lower. If I were OPEC or a large oil company, I would be selling the shiznit out of the futures right now!!

If you have been reading this blog, you know that I'm an energy bear (see post: Crude Oil Set To Tank?). I stand by my call that supply can and will grow faster than demand in 07 and that OPEC cutting supply and freeing up spare capacity is a bearish event. If it were not for all of the hot money flowing into energy derivatives over the past couple years, the price of oil would be much, much lower. If I were OPEC or a large oil company, I would be selling the shiznit out of the futures right now!!

5 Comments:

Are you currently short energy? Or, are you more in the 'avoid' camp?

I guess what I'm really trying to ask is... I read in an earlier post of yours that about half of your 401k is in the Total Stock Market fund... are you currently (or considering) shorting enough energy to effectively nullify the energy component of the overall market?

While I'm not really all that bullish on energy, I don't necessarily see the sector plummeting. But, I do think that you make good points to support your stance.

I'm not short anything at the moment and I probably won't short the energy index, but I might. I'm essentially underweight the sector though because my growth funds have very little energy exposure and non of my individual stocks are energy related.

The energy stocks are about 90% correlated with the underlying commodity, especially the high beta names (drillers and service companies), so if oil prices drop 30%, the stocks will take a pounding regardless of their P/E's because investors will discount the future profit declines in the share prices immediately. There is much more risk in this sector than most people think, which is one of the reasons I've been talking about it so much. My stance is contrarian to some of the most popular and widely followed talking heads. Most people do not think oil prices are in a bubble.

Other areas that look bubbly in general include copper, steel, utilities, REITs and small caps. The most undervalued areas in general are probably large caps, HC and selective tech, which are the areas I'm overweight.

This comment has been removed by a blog administrator.

Here's a question then.

What line would I have to offer you to get you to take the Under at even money for the front month oil contract on July 1 2007?

I would bet a lot of money on over 55 and a LOT of money on over 50 and these stocks seem to trade at a multiple that implies Under 50

You are talking about the WTI Crude contract, correct? I will take the under at $57.

Post a Comment

<< Home